Mencap Trust Company Ltd is unlike any other professional trust company in the UK

Our not-for-profit model enables families to provide financial security for loved ones without affecting means-tested benefits entitlements.

Our low fees make us a realistic option for families who want to gradually build up

a trust

A Trust looks after money for a person or a group of people.

during their lifetime. We also manage trusts settled from gifts in wills.

A Trust looks after money for a person or a group of people.

during their lifetime. We also manage trusts settled from gifts in wills.

We look after 1,000 trusts. That’s 1,000 people with the good fortune to have a financial cushion to help them for the rest of their life.

"Peace of mind for you, security for your loved one."

Year in review

2018/19 has been a busy and enjoyable year.

The Mencap Trust has grown. Stacy East and Alison Lewis joined the Trust Team as full time Trust Relationship managers. They focus on building

relationships

Relationships are about the people in your life. You might have different types of relationships like friendships, family relationships, or a boyfriend or girlfriend.

with each beneficiary and the people who support them.

Relationships are about the people in your life. You might have different types of relationships like friendships, family relationships, or a boyfriend or girlfriend.

with each beneficiary and the people who support them.

There were 148 review visits made during the year. These home visits continue to be at the heart of our work. We meet each beneficiary and the important people in their lives face-to-face, in the person’s home. This gives us lots of information and ideas about how trusts can be used. It allows us to really understand the needs, challenges and aspirations of the people we are working for.

Over the last few years more and more parents have put money in to trust during their lifetime. This means that we have more parents to talk to, and work with. Families have helped us design and introduce an

easy read

Easy Read is a way of making written information easier to understand. Pictures are usually added next to the writing.

Trust Request form, and we continue to work to improve our request processes, always aiming to increase the number of requests received. We make a difference by encouraging trust requests. It is very pleasing that the number of trust payments made is up by 30% compared to last year.

Easy Read is a way of making written information easier to understand. Pictures are usually added next to the writing.

Trust Request form, and we continue to work to improve our request processes, always aiming to increase the number of requests received. We make a difference by encouraging trust requests. It is very pleasing that the number of trust payments made is up by 30% compared to last year.

Our newly introduced Mencap Trust Club has been very popular. Our last meet-up of 2018 was in November, at London’s Natural History Museum. Over 60 people came along: beneficiaries, their support staff, family members, and Mencap Trust staff. It was an informal, super-friendly event, full of smiles and conversations about shared experiences.

We know that to be a successful Trust company for those with learning disabilities and

autism

Autism is a disability. Autistic people find it difficult to understand what other people think and feel. They also find it difficult to tell people what they think and feel. Everyone with autism is different.

, we need the insights and knowledge of parents, legal and investment experts and, of course, those with learning disabilities. That’s why the Mencap Trust Company and its unpaid Board is made up of a unique and diverse team that covers all these areas. We combine our knowledge and skills to deliver the promise we make to each settlor, today and for many decades to come.

Autism is a disability. Autistic people find it difficult to understand what other people think and feel. They also find it difficult to tell people what they think and feel. Everyone with autism is different.

, we need the insights and knowledge of parents, legal and investment experts and, of course, those with learning disabilities. That’s why the Mencap Trust Company and its unpaid Board is made up of a unique and diverse team that covers all these areas. We combine our knowledge and skills to deliver the promise we make to each settlor, today and for many decades to come.

This year, we began working with 23 new beneficiaries and set up 56 new trusts. We are really looking forward to working with these new families and making sure that each trust makes the positive difference they hope for.

Our activities: April 2018 - March 2019

We have made 148 visits to beneficiaries in their own homes. Visiting the person in their own home, with the important people in their lives, is at the heart of how we encourage requests in order to make a positive difference to each person’s life.

We have made 894

discretionary

Discretionary means it is up to somebody to decide if you get something.

payments from the trusts, totalling £431,000. Trust funds can be used for anything. Regular payments have been made for massage, hydrotherapy, and music and art sessions. Bedrooms have been refurbished, birthdays celebrated, holidays enjoyed, and football matches attended. Each payment has a story, and it is a privilege to be involved.

Discretionary means it is up to somebody to decide if you get something.

payments from the trusts, totalling £431,000. Trust funds can be used for anything. Regular payments have been made for massage, hydrotherapy, and music and art sessions. Bedrooms have been refurbished, birthdays celebrated, holidays enjoyed, and football matches attended. Each payment has a story, and it is a privilege to be involved.

24% of trust funds pay for extra support so that people can do more. Sometimes we need to help the person with the trust and the important people in their lives find support. This year we have found and paid for additional support for 20 people.

48 people had holidays paid for by their trusts. Going on holiday can be expensive, and we also paid for new clothes, and provided extra spending money for the trip. Most people chose organised holidays with a group, but group holidays aren’t for everyone. We paid the extra costs of 1-2-1 holiday support for 5 people to go on the holiday they chose for themselves.

Our most significant single transaction was the purchase of a home for Simon.

We set up 56 new trusts for families. The trust is the instrument which will protect future gifts to the person.

We received funds into trust for 23 new beneficiaries.

Not all funds come from bequests in wills. 17 were lifetime settlements. The number Mencap Trusts which are lifetime settlements is growing. Parents are involved in 92 of the 252 active trusts we hold. This gives us the opportunity to work together to learn how to operate the trust for the individual.

For the 6 trusts settled from bequests we are guided by the Letter of Wishes. We encourage families to keep in touch with the Trust Office, and to update their Letter of Wishes at any time and at no cost.

Sadly, 7 beneficiaries passed away in the year. Our job is to help each person with a trust benefit from that good luck for their lifetime. It is a privilege get to know each person and to help. Each one will be missed.

Mencap Trust owns 3 properties in trust that are homes for three beneficiaries. Golden Lane Housing (GLH) manage and maintain these properties for us. They also rent a home to a fourth beneficiary under the Great Tenants Scheme.

On 5th April 2019 we held £24.2m of assets in trusts.

Call us on 020 7696 6932 or email mtc@mencaptrust.org.uk if you have a question we haven't answered yet.

Hear from Esther

"I went to Orlando. Travelling is the best"

- Esther

Gary's year

Gary is a gifted mathematician and champion chess player. He had to defer his Phd because of his autism and severe social anxiety. Daily tasks overwhelm him. The most important thing for Gary is a quiet and peaceful home of his own.

This year Mencap Trust worked with Golden Lane Housing and with Gary’s Mum and Dad. Mum and Dad found a property with Gary. When Gary chose the property he knew he was accepting a big challenge. He also knew that this is the home where he will find peace and clear his mind.

The Trust bought the property and have leased the property to GLH, through the Our House scheme. Gary will be a GLH tenant, and they will support him to maintain the tenancy and keep the property in good repair. Mencap Trust will visit Gary each year and Alison, Gary’s trust relationship manager, will be in regular contact. She will make sure he understands how the trust works and is able to ask for the things he would like.

Gary is gradually moving in to his new home. It is an anxious time for him and he needs consistent and patient support from his circle of support to make the move.

Gary is not thinking about the next steps after moving. They are very big steps towards his dream. Gary’s dream is to fulfil himself by completing his PhD in pure maths, playing chess at the highest level, and finding friends.

Hear from Gary's parents

"Gary is an exceptional young man, who is held back by his OCD and severe anxiety.

We have learned to go at his pace and we are proud of him."

- Helen and John, Gary's Mum and Dad

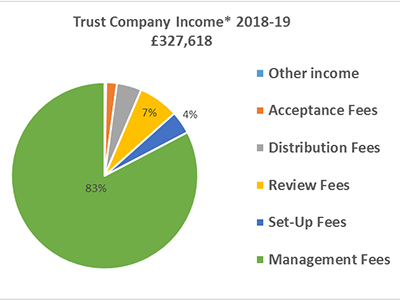

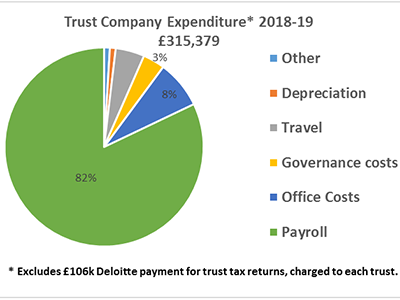

Income and expenditure

Key figures

83%of our income is generated by our management fee raised on funds under management

82% of our expenditure pays the staff

Total income was £328,000

Total Trust Company costs were £315,000

Reserves

We ended the year with reserves of £79,000.

These reserves provide us with a cushion for unforeseen events. It allows us to continue to provide an excellent and consistent service, while at the same time expanding our outreach to as many people who would benefit from our service as possible.